Enterprise product management has a number of crucial differences to B2C product management, and understanding these is critical to being successful in each environment.

Both systems have pros and cons. Some people love enterprise product management as they get to build in businesses where the product is front and center. Some people love B2C, or mass market product management, because of the rich data points volume provides.

Product management as a whole has a common goal – to create business value by solving customer problems. But the fundamental characteristics of companies serving enterprise customers vs. mass market companies are very different. The result of this is the way PMs work in each type of company contrasts significantly day-to-day.

If you have a lot of customers, or a large possible target group, each can pay you a small amount, and you’ll still have a big business (B2C or mass market approach). In scenarios where a lot of customers are available, you should expect high competition for those customers, which similarly pushes pricing down (supply and demand).

But if you only have a few customers who have a need for your product, and you’re looking to make money, each of those customers must pay you a very large amount to get the same result (Enterprise B2B approach). In addition obviously you need to provide value to the end customer in line with your pricing.

This fundamental truth then determines a number of other core characteristics of a product:

However, this is clearly not a binary distinction, but rather a spectrum of customer sizes along which all products lie, ranging across:

In this article we’ll cover the principles shared across this spectrum, and highlight the differences between the two ends of it.

While we focus on enterprise B2B and mass market B2C products, each of these dynamics come into play to different degrees depending on where you play.

Despite the differences in context between B2C and enterprise product management, the principles of product management are the same:

With the shared principles noted, let’s take a look at the differences between B2C and enterprise B2B companies. We’ve grouped these together into 5 major categories:

These are the core attributes of companies selling to enterprises, which ultimately drive the other differences you see in enterprise product management.

In B2C products you have lots of customers – the biggest B2C products like Facebook and WhatsApp have billions of users. Meanwhile, enterprise B2B companies have far fewer, and a small enterprise company could be sustainable with <10 customers. While B2C2B motions do exist (for example, Udemy), the fundamentals of how you service many or few customers remain consistent.

That means the value of each customer you serve needs to be much higher in enterprise. While in B2C your price point might be $10-100s, enterprise companies might charge each customer $100ks or $1ms.

You can only justify such high price points if you are delivering a lot of value. Whilst mass market consumers might spend a few dollars for fairly intangible value, enterprise customers are usually looking for a return on investment (ROI) for what they spend. As a result enterprise products often explicitly target delivering a demonstrable ROI of 5-10x for their customers to facilitate an easy sell.

B2C companies have simple pricing and typically rely on automated transactional business models that customers can easily leave (e.g. purchases / ad revenue). Even where B2C companies do rely on subscriptions or contracts, these are typically fairly short lived and can be left relatively easily. As a result, B2C companies don’t weigh the voice of any one customer very highly – there are lots of other customers to serve.

In contrast, enterprise B2B companies tend to sell via a person, customize their pricing and have contractual business models – this is the natural response to having far fewer, much bigger customers. Pricing might be structured, but contracts are often negotiated client by client, run over multiple years, and might include set up or services fees, all of which introduces some variability in the size of accounts.

This is often exacerbated by B2B companies charging for usage or volume, which means that some customers can end up being worth much more than others. The result is that revenue is often distributed very unequally across the customer base, with the biggest customers dominating revenue and thinking.

While B2C startups have the challenge of getting enough customers to be viable, they can rely on those customers all buying roughly the same thing. Enterprise startups can be viable with just 1-2 big contracts, but as they scale it’s easy for them to run into “revenue debt”, or contract revenue dependencies, where they pick up a variety of customers all with different needs, and who saying “no” to is painful (if indeed possible).

In B2C you’re usually dealing with one major use case, and often the customer and user are the same person (e.g. Spotify, Tinder, Monzo, the person using the product is the person paying for it). In low cost B2B models (e.g. Figma, Notion) the same tends to be true, with company wide contracts being a function of volume.

With enterprise sales you’re serving a company, and companies are large groups of people. The end user and the buyer are different people, and indeed the buying process might involve input from lots of different people (e.g. end users, managers, execs, legal, IT … ). Each of these personas can torpedo a deal, and will likely have different concerns and priorities.

Sales cycle

With a transactional business model, low transaction values and a single person making decisions, the sales cycle in B2C is often short or effectively instantaneous.

Enterprise B2B has the reverse qualities. The large sums of money involved and what they are buying are defined in detailed contracts. These are reviewed and signed off by multiple people, each who want different information and proof points. And once the deal is done, there may be implementation and roll out phases before the bills come due. The result is a sales cycle that can last months or even years.

Discovery

How you understand your customers and users also varies significantly between B2C and enterprise product management, due to the difference in scale and how alike different customers are.

Understanding your users

In enterprise product management you have fewer customers, so user research is more ethnographic – you understand your customers by speaking with them. In the best case, you’re dealing with expert users who can clearly articulate their needs, making feedback more straightforward.

You’ll undoubtedly get direct feature requests from customers, and the challenge is to find out whether or not there is a broader market for these features. But also the challenge is the same as with any discovery – to uncover the reason why they’re asking for certain feature sets.

With enterprise sales it’s common to identify 1-2 development partners or to create a Customer Advisory Board of top clients. This group not only helps you stay aligned with customer needs and quickly address pain points, but also provides a group to run beta programs with and test new features.

However, there are a couple of challenges to this sort of co-creation:

- Sales team is possessive of the customer relationship

Sales might be worried that an offhand comment could jeopardize a relationship they have spent years developing, and on which their bonus relies. All the more so if they don’t understand the product roadmap because you haven’t explained it well enough, or they’ve filled a knowledge vacuum or exaggerated about the readiness of the product and what it can do.

- Many enterprise customers are naturally risk averse

They tend to ask for what they already know – “a faster horse.” This can make designing and selling disruptive innovations harder to sell. Buyers have their own bonuses, careers, and reputations on the line, so there are significant disincentives for them to make bold changes.

In B2C, on the other hand, understanding your users is more data-driven. While direct conversations are obviously important and provide much needed depth and color to your customer understanding, you also want to get insights at scale.

As a result you look at usage data, reviews, customer support interactions, and marketing results. You’ve got the user numbers to run sophisticated AB testing which just isn’t viable in many large scale B2B contexts. It’s a much more quantitative approach, relying on patterns and trends across large user bases to inform product decisions.

Check out the Hustle Badger Product Discovery Course

Go To Market Motion

One of the biggest differences between B2C and enterprise companies is in the go-to-market motion.

Distribution

In mass market B2C you’re trying to reach lots of customers with a very similar message. And you have to do this at a low cost – the CLTV (customer lifetime value, or total worth) of your customer is likely to be <$1,000, and often much lower. As a result, B2C companies lean into mass marketing channels which can be run at huge scale and convert customers with few touches.

In enterprise B2B the contract size is much bigger – often >$100,000 and you have to convince multiple decision-makers. Similarly there’s likely to be a small subset of customers who meet your buyer criteria or match your ideal customer profile.

Not all marketing tactics which you might be familiar with from B2C companies can be used in an enterprise context, depending on the target or ideal customer profile. Similarly because of the price of the transaction and the number of touchpoints pre purchase, marketing teams might be far more focused on pre and post purchase customer nurture than on traffic acquisition volume and user journeys onsite.

Additionally this means a Sales team who makes personal contact with customers is almost always the backbone of an enterprise product’s go-to-market strategy: be it in the acquisition or post purchase stages of the funnel. Initiatives such as events, product-led growth (PLG) and marketing events are generally used to feed the Sales team, not replace it.

Sales culture

The marketing teams in B2C companies tend to think relatively similarly to product teams – that is, at scale. One or two extra customers won’t make a difference to them, though they might request features that they believe can open up new segments or will appeal to large numbers of prospective customers.

But sales teams in enterprise B2B are chasing a handful of deals each. Each deal is worth a lot of money, so sales people are highly incentivised to make them – often a significant proportion of their take home pay will come from their bonus. That means a single deal might be the difference between them getting their bonus and going on holiday this year. Or even paying their mortgage.

Under this pressure, sales teams request product features to close deals. While this is a common complaint from enterprise product managers, it’s worth understanding the root cause of these requests, as it provides important signals into the company strategy:

- Poor training or enablement – sales teams don’t properly understand the product and value it offers customers. Nor are they supported with product marketing, website copy or sales materials to help them to sell well.

- ICP is too narrow – the ideal customer profile (ICP) is too tightly defined and the market isn’t big enough. As a result the sales team doesn’t have enough leads to chase, and starts targeting prospects outside the target profile.

- ICP is too broad – the ICP is too vaguely defined, or can’t be easily recognised from the information the sales team have. This means the sales team targets lots of prospects that are actually a poor fit for the value the product can deliver.

- Insufficient value – target customers aren’t seeing enough value, so deals don’t close. Sales request features to increase product-market fit (PMF).

- Poor incentivisation – sales teams will execute against the rewards they get in their incentives structure. If they have high new revenue targets they might load up a contract’s value – and sell product features as a result. Poorly structured incentives can cause a lot of issues.

Not to mention that any of these dynamics can be magnified by customers who feel they are entitled to a bit of special treatment because they are writing a big check.

Poorly handled or misdiagnosed, this puts huge pressure on the rest of the business to fall into line and build bespoke features in a way that is totally absent from B2C product management.

How to collaborate effectively with sales teams

Different time windows

Enterprise product management teams often work on long horizons. Particularly in enterprise contexts, working on complex products, they might be looking to deliver significant value over a 1 year period. Sales and marketing people are nearly always under immediate target pressure to deliver results that month or that quarter. This can lead to very different views on what to do today, since the pressures and reward structures for each group differ significantly.

“To give an example, marketing might be tracking paid ad performance on a daily or weekly basis for bidding purposes. Sales is tracking against an annual number and they’re looking at it monthly and quarterly. Product people might be looking ahead a quarter or at most a few quarters, but they may also have responsibility for new product lines and new paths to growth for the company that don’t exist today….

I think a lot of times all these functions get together to try and make a decision and the marketing folks are thinking about tomorrow, the sales folks are thinking about next month, the product people are thinking about next year, and the tech people are thinking about next year or into the future. There’s no way that they’re going to arrive at the same decision about what to do next in that context.” – Dave Wascha, CPTO, ex Microsoft, ex Zoopla

Ongoing customer development

In B2C companies, purchase retention usually involves the customer repeat purchasing routinely (potentially on subscription, but habitually in ecommerce and marketplace contexts). That means the value you get from one customer either stays relatively similar (if they are retained), or declines (if they churn).

Whilst this seems obvious, the same is not true for enterprise products. Here there is often a “land and expand” strategy, where companies aim to increase the value from each customer over time. This is done by:

- Increasing adoption of the same product (e.g. increasing number of seats a customer purchases)

- Upselling the customer new functionality that costs more

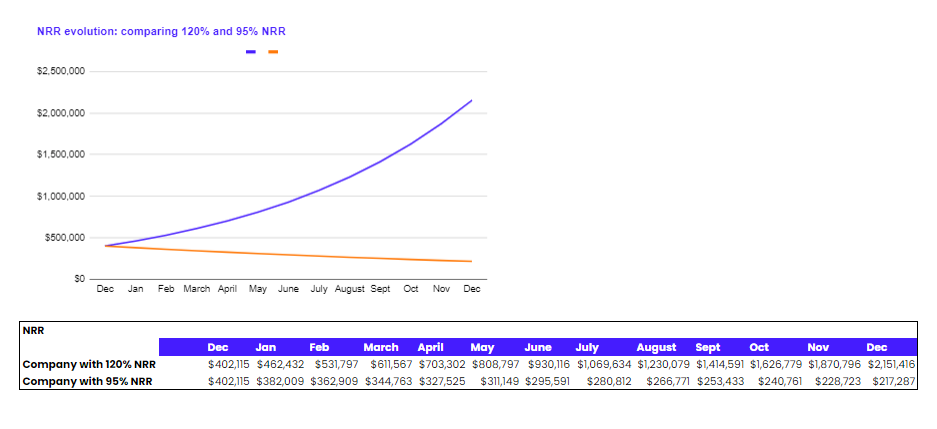

In SaaS companies, there are clear metrics and benchmarks for this. Net Retained Revenue (NRR) is the ratio of this year’s revenue to last year’s from existing customers. High growth enterprise companies often target an NRR of >115%.

This is facilitated by customer success teams looking after existing customers who might be separate from the sales teams acquiring new customers. However enterprise product managers also play a key role here.

For enterprise product management teams, this means that every year there’s scrutiny on activation, churn and pressure to build more add-on products and new features that can be sold to existing customers.

Comparing the growth rate of a company with 120% and 95% NRR

Product Marketing

In B2C, product marketing is primarily about getting the value proposition and messaging right. The focus is on crafting a clear, compelling story around the product that resonates with a broad audience and drives conversions. Since B2C products are often straightforward, easily accessible and intuitive, there’s little need to dive deep into explaining specific features or roadmaps.

The product needs to speak for itself, and the emphasis is on high traction channels, optimizing customer journeys and landing pages, and app store listings to deliver that message effectively.

But for enterprise products, product marketing plays two roles:

1. Lead generation

Enterprise product marketing supports the sales team in bringing in new customers. This involves not just nailing the value proposition but also often includes sharing a public product roadmap or vision. In B2B, where customers are signing multi-year contracts and making substantial commitments, the roadmap becomes a crucial part of the pitch.

Enterprise product managers and marketers might even join sales calls to explain product features to potential and existing clients. It helps build confidence in the product’s future, showing potential customers that the company is investing in long-term growth and development that will meet their evolving needs.

2. Retention and upsell

Enterprise product marketing supports customer success, driving engagement and adoption by educating existing customers on new features. As enterprise products are complex, lots of effort goes into educating customers on how to use them, as this supports engagement and repurchase. In practice this involves creating in-depth documentation, running training sessions and sending out engaging release notes.

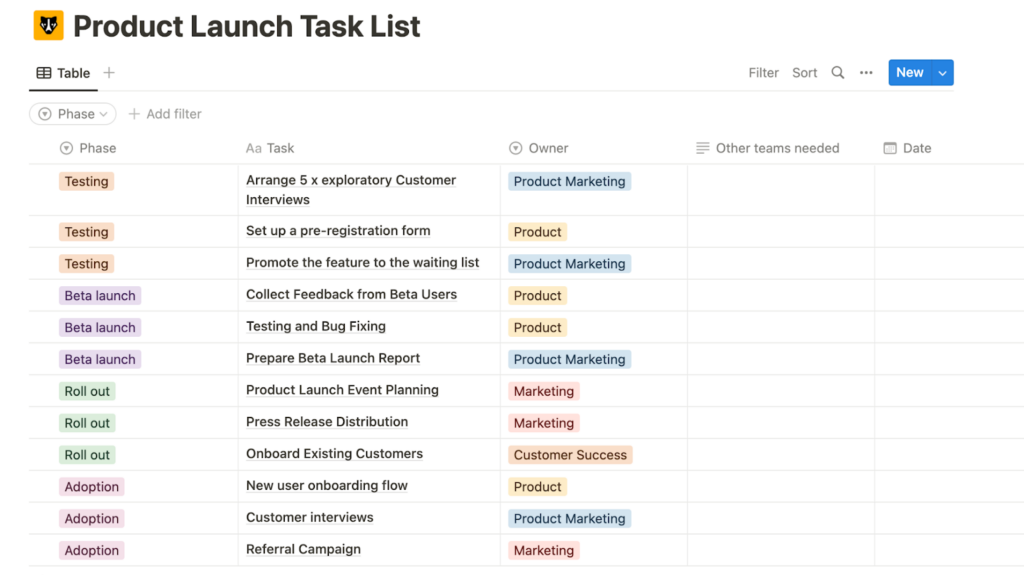

Example product launch plan task list in an Enterprise context

Retention

In B2C, retention is largely driven by the value the product directly delivers. When the product is valuable and easy to use, customers keep returning on their own.

Enterprise products must also deliver enduring value to customers, but can also rely on a variety of other levers to support longer term retention, such as:

- Legal lock in – through long-term contracts, approved supplier lists, or accreditation

- Integrations – connecting with other business systems

- Process – becoming an integral part of critical workflows, or being part of a process that requires training lots of employees (e.g. customer service workflows)

Once a company has deeply embedded a B2B product into its operations, switching becomes difficult and costly – something that’s less of a factor in B2C.

The Enterprise Product Manager

With all the differences between B2C and enterprise, it should be no surprise that the PM role often looks quite different between the two as well.

Enterprise PMs are not just building the product – they’re integral to client relationships and product marketing. It’s common in enterprise product management for PMs to play an active role in the sales cycle through a combination of three key activities:

- Delivering demos

- Responding to information requests (RFI/RFP/RFQs and InfoSec audits)

- Managing incoming feature requests from both new and existing users

This is on top of the other work they are doing to understand their customers and build valuable solutions for them. This sales responsibility extends right up into product leadership, with CPOs often “man-marking” the largest or most demanding clients, maintaining close relationships with them to resolve issues and drive value.

That means that the PMs who succeed in enterprise product management excel in customer-facing interactions, balancing industry and technical knowledge with the ability to communicate the product vision and roadmap effectively.

This contrasts with B2C product management, where the sales cycle is much less personal for everyone. Here PMs are operating at scale, with lots of data. It’s about doing fewer things, but doing them exceptionally well to build products that resonate with a broad audience and drive long-term engagement.

The Product

Mirroring the difference between B2C and enterprise product management, the products themselves, with enterprise products requiring a number of common features and capabilities.

Release Cycles

B2C consumers are increasingly used to digital products changing, and it’s only in exceptional cases (Snapchat’s redesign of 2018… Sonos’ new app in 2024…) that there’s a meaningful pushback from users and consequences for handling this poorly. When Google updates its search results or Spotify its home screen, users might grumble, but the change is quickly accepted as the new status quo.

In contrast, with B2B products, users are often using your product to fulfill critical workflows in their day-to-day jobs. Changing even small details like the navigation (e.g. Salesforce) might unexpectedly break their flow through the product and cause anything from immense irritation to real costs. This puts more onus on B2B companies to test functionality before rolling it out, and educate users on major updates so they understand what is changing and why.

UX

The flip side of B2B customers relying so heavily on B2B products is that they can tolerate very bad UX if the core value is there. Enterprise B2B UX is being pushed towards consumer standards, but still has a long way to go. Enterprise product management squads may often not give this much thought.

Mass market products are often hyper-focused on UX and small optimizations because their customers will readily drop a product or switch to a competitor if they can’t figure it out. That means that small tweaks in the UX can have a big impact on conversion, and are worth getting right.

Integrations

Enterprise products more often than not have a workstream building ever more integrations with other B2B products their customers use. This serves three functions:

- Customer value – Integrating with other data sources and systems allows B2B products to offer more value to their customers.

- Customer lock in – Additional integrations embed B2B products deeper with their customers, making it hard to replace them. This drives down customer churn.

- Commercial / co-marketing reasons: in more mature spaces, partnerships between providers to co-market and co-push each other’s complimentary products are ever more commonplace.

In B2C, this is much less common, as most products aren’t being used in a work setting.

Security

Enterprise companies tend to value data security and localisation to protect themselves from malicious attacks, mistakes, and comply with regulation. As a result, they have well developed internal security functions and policies, and these require suppliers to also have high security standards.

To prove their data security credibility, most enterprise products pick up security credentials like ISO27001, Cyber Essentials, or SOC2 compliance. Depending on the data they touch, they may also need to store data from different customers locally, with European data stored in Europe and so on. Enterprise product management often requires working closely with tech leads to achieve these standards.

Consumers are less sophisticated when it comes to cyber security and rarely factor this into their purchasing decisions.

Roles & permissions

Enterprise products will often have lots of users at a single customer, and as we mentioned above, these might be spread across some very different personas. As a result, enterprise products commonly need to offer different roles and permissions – think managers having oversight of their team’s activity in Salesforce or Zendesk. People who succeed in enterprise product management roles are often very cognisant of the requirements of different end users whose needs they serve.

In B2C, in most cases the user is the customer, with each account being a single person, so this whole challenge is avoided.

Wrap Up

While the principles of product management remain the same, the day-to-day realities of mass market and enterprise product management look quite different.

B2C product managers focus on building intuitive, easy-to-use products that resonate with a broad audience. With many customers, no single customer is overly important, and product and marketing strategies aim to maximize the scale that the company can operate at.

In contrast, enterprise product managers are serving a smaller number of customers signing much bigger deals. The number of people involved in each side of the relationship is much greater, the sales cycle longer, and PMs are often involved intimately in this. With enterprise deals the key to a successful business often revolves around building a lasting relationship with your customers through the product itself, integrating into their operations, personal relationships and contractual terms.

Despite these differences, both Enterprise product managers and B2C PMs are ultimately responsible for creating hard-to-copy solutions that deliver long-term value. Whether you’re working in a high-volume consumer environment or with a small number of enterprise clients, the core job remains the same: understanding your users, solving their problems, and driving meaningful results for the business.

Hustle Badger Resources

[Articles]

[Courses]

Other Resources

FAQs

How does Enterprise product management work?

Enterprise product management is focused on driving business value and serving customers in innovative ways. However it differs from standard B2C models in various key ways.

First of all, in Enterprise product management there’s a need to work constructively with a sales organization who work directly with the customer. There’s a need to share and collaborate on roadmaps, assist with sales enablement, work with them on discovery, and understand the root drivers of their feedback.

Secondly, Enterprise product management operates in a less data rich environment, with fewer customers paying high amounts, meaning that discovery and development can develop into a service led model to retain larger contracts. This can create unique pressures for Enterprise product managers.

Finally security, data privacy, and data storage requirements are often much higher in Enterprise product management.

What is the role of an Enterprise product manager?

The role of an Enterprise product manager is to create customer and business value. However the ways in which they might achieve those goals often differ significantly to other product management contexts.

An Enterprise product manager works tightly with GTM market teams to close deals, get feedback from customers and maintain long term customer relationships. Their relationships with users tend to be qualitative and face to face, rather than data point driven.

The time windows in which an Enterprise product manager serves customers can last for many years, and small groups of key customers might drive revenue and product development priorities. Finally the way that an Enterprise product management squad develop and ship value add products or feature sets might also differ significantly to other contexts: value might be delivered via security features, integrations and purchase decision maker needs, as well as end user improvements to the product itself.